A PAN card is a 10-digit alphanumeric number issued to the country’s liable taxpayers. It can also be issued to foreigners and foreign entities if certain criteria are met. It is important to quote a PAN card to initiate financial transactions. An applicant can apply for a PAN card either online or offline.

In addition, an applicant can obtain an e-PAN card instantly by using an Aadhaar card. An e-PAN card is issued to the applicant in the form of a soft copy. It functions exactly like a physical PAN card and is acceptable for all types of financial transactions.

In this blog, we will explain how to apply for a PAN card through an Aadhaar card in detail.

How to Apply for a PAN Card through an Aadhaar Card?

Following are the steps to follow to apply for a PAN card through Aadhaar card-

- Visit the official website of the Income Tax Department

- Click on ‘Instant e-PAN’

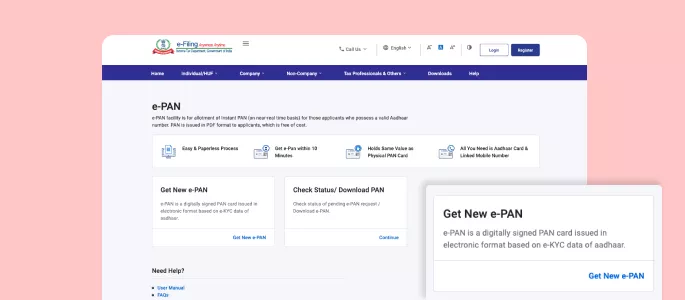

- You will be redirected to another page, click on ‘Get new e-PAN’

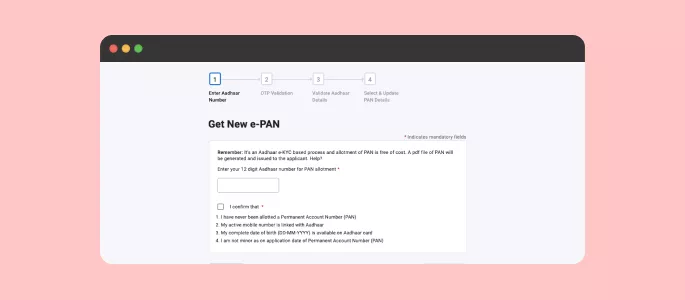

- Enter 12-digit Aadhaar number and confirm the declaration

- Next, get the OTP verification done

- A 15-digit acknowledgement number will be generated to track PAN card status

*It should be noted that the e-PAN will be sent to the applicant’s e-mail address registered with the Aadhaar card

How to get an e-PAN Card online?

An applicant must fulfil the following requirements to obtain an e-PAN card through an Aadhaar card-

- An applicant’s mobile number must be linked to his or her Aadhaar card

- Applicant should submit a valid Aadhaar number that is not linked with the PAN card earlier

- There is no need to submit documents for KYC

- An applicant should not have 2 PAN cards

What are the Documents Required to Apply for a PAN Card?

No documents are required when a person applies for a PAN card using his or her Aadhaar card.

What is the Fee to Apply for a PAN Card through an Aadhaar Card?

An applicant does not need to pay a fee when he/she applies for a PAN Card through an Aadhaar card.

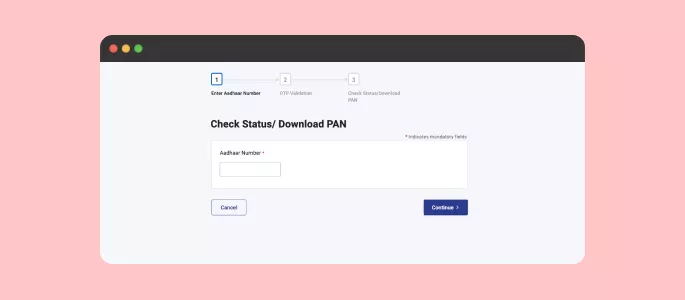

How to Check PAN Card Status?

It is easy to track the PAN card status online. All an applicant needs to do is to follow the steps given below-

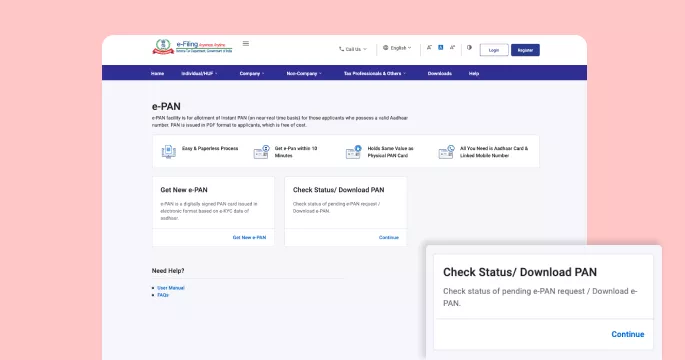

- Visit the official website of the Income Tax Department

- Click on ‘Instant e-PAN’

- Next, click on ‘Check Status/Download PAN’

- Enter 12-digit Aadhaar number, click on ‘Continue’ to check PAN Card status

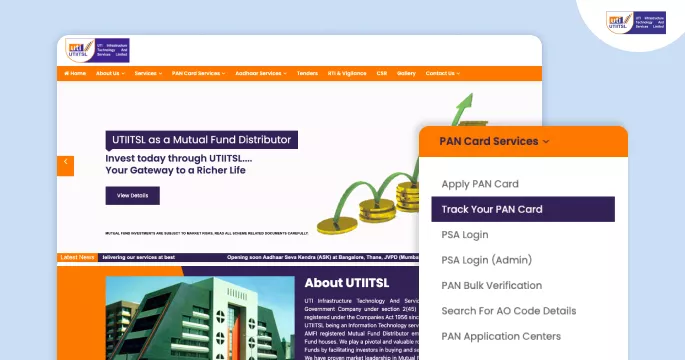

There is another way to check PAN Card status by following the given steps-

- Visit the official website of UTIITSL

- Locate ‘PAN Card Services’ and click on ‘Track your PAN Card’

- Enter the application coupon number or PAN number

- Select date of birth/incorporation date etc

- Enter captcha code and submit to check PAN Card status

What is a PAN Card?

A PAN card is a 10-digit alphanumeric unique number issued by the Income Tax Department of India as per the Income Tax Rules & Acts.

How will I get the PAN card if I apply for it through an Aadhaar card?

You can download the PAN card. It is also sent to the email address which is linked with your Aadhaar card.

What is an e-PAN card?

An e-PAN card is an electronic PAN card. It is issued in electronic form by the Income Tax Department and works similar to a physical PAN card and can be submitted for all financial transactions.

Is an e-PAN card a valid form of PAN?

Yes, an e-PAN card is a valid form of PAN. It can be submitted for initiating financial transactions.